For decades, the classic advice for building wealth has been diversification. “Don’t put all your eggs in one basket,” they say. Traditionally, this meant a mix of stocks, bonds, real estate, and maybe some commodities. But for most individual investors, accessing a truly diversified portfolio has been challenging. High-value assets like fine art, commercial real estate, or venture capital funds were often out of reach.

The world of investing is evolving, and for us who believe in financial freedom and the power of crypto, tokenized assets are the next frontier. They’re not just a technological gimmick; they’re a new way to access a wider range of investment opportunities.

So, how can you build a powerful, diversified portfolio using tokenized assets?

Building Your Tokenized Portfolio: A Strategic Approach

| 01 | 02 |

| Define Your Goals and Risk Tolerance This hasn’t changed. Are you investing for long-term growth, stable income, or capital preservation? Your strategy will determine your asset allocation, even in a tokenized world. | Understand the Core Asset Classes Think of your portfolio in layers. Tokenization allows you to diversify within each layer more effectively. |

Layer 1: Traditional Assets (Tokenized Versions)

This is your foundation and here is an example of assets that investors often invest in.

- Bonds: Tokenized government or corporate bonds offering yield.

- Stocks & ETFs: Tokenized versions of major company stocks or entire indices.

Layer 2: Real-World Assets (RWA)

This is where diversification gets exciting.

- Real Estate: Tokenized residential and commercial properties across different geographies.

- Commodities: Tokenized gold, oil, or agricultural products.

- Art & Collectibles: Fractional ownership in blue-chip art or vintage cars.

For balanced exposure, consider the foundational layers of the ecosystem itself.

- Blue-Chip Cryptocurrencies (e.g., Bitcoin, Ethereum): Often considered “digital gold” or a speculative growth asset.

- Staking & Yielding: Earning passive income by participating in blockchain networks.

Step 3: Choose a Reputable Platform

You can’t buy these tokens on just any exchange. Do your due diligence and use licensed and regulated platforms that specialize in tokenized real-world assets. Look for platforms with strong security, transparent fee structures, and a track record of compliance.

Another option for buying your assets is using a P2P (Peer-To-Peer) approach, however there is more complexity and risks involved.

Step 4: Execute and Allocate

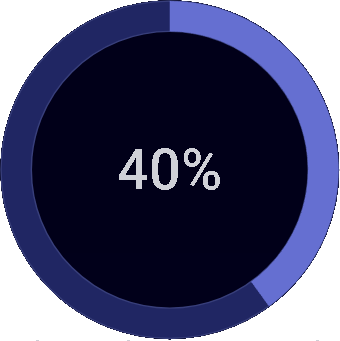

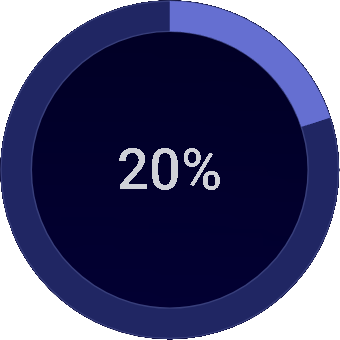

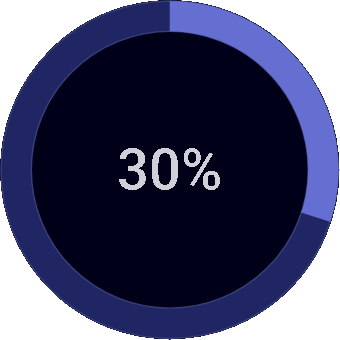

Start small. You might begin by allocating a small percentage of your portfolio (e.g., 5-15%) to tokenized assets. A sample, conservative allocation could look like:

Tokenized Treasury Bonds

for stability and yield

Tokenized Gold

a classic safe-haven asset

Tokenized Real Estate Fund

for income and inflation hedging

Diversified Crypto-Native Assets

for growth potential

Step 5: Monitor and Rebalance

The market for tokenized assets is still young and evolving. Regularly review your portfolio’s performance. Use the enhanced liquidity to your advantage by rebalancing your allocations as your goals or market conditions change.

A Word of Caution: Navigating the New Frontier

With great innovation comes new risks. It’s crucial to be aware of:

Regulatory Uncertainty

Regulations are still being developed. Stay informed about the legal status of tokenized assets in your jurisdiction.

Liquidity Risk

While improved, secondary markets for some niche tokenized assets may still be illiquid. Be prepared to hold for the long term.

Technology Risk

While secure, blockchain platforms can be vulnerable to smart contract bugs or hacking. Use platforms with audited code and strong security practices.

The Future is Fractional

Tokenization is more than a buzzword; it’s a fundamental shift toward a more open, efficient, and inclusive financial system. By allowing you to build a truly global and diversified portfolio from the ground up, it empowers you to take control of your financial future in a way that was never before possible.

The baskets for your eggs are no longer limited to a few shelves. The entire warehouse is now open for business.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions. Investing in tokenized assets and cryptocurrencies involves significant risk.